Alaska Cannabis Legalization and Licensing

Alaska is the first state to have a single cannabis industry, rather than separating out medical and recreational markets.

In 1998, Alaska legalized medical cannabis through majority vote of Ballot Measure #8 which allowed qualifying patients in the state to utilize medical cannabis as a form of medicine.

In November 2014, the production, sale and distribution of recreational cannabis was legalized which took effect on February 24th 2015.

Available license types

- Retail cannabis store license

- Cannabis cultivation facility license

- Cannabis product manufacturing facility license

- Cannabis testing facility license

Vertical integration is permitted. Only testing licensees may not hold other cannabis business licenses. Alaska cannabis licenses are tied directly to the physical location for the business. Moving to a new location requires a new license application. There is no cap on the number of licenses that can be issued, or the number of licenses for a single individual or company.

State residency requirement

Each business partner in an Alaska cannabis business must be a state resident eligible for a Permanent Fund Dividend. That means having lived in Alaska for at least one calendar year.

Premises restrictions

State regulations require that all marijuana businesses must be at least 500 feet away from schools and churches. Towns may add additional restrictions, such as zoning ordinance. Towns may also require a conditional use permit. Businesses are also required to advertise their intentions for three weeks.

Information regarding each license is highlighted below:

Retail cannabis store license:

- Allows for a licensee to sell cannabis obtained from a licensed cannabis cultivation facility to qualified individuals (21 years and older)

- Allows for a licensee to sell cannabis products obtained from a licensed cannabis product manufacturing facility to qualified individuals (21 years and older)

- Permit consumption of cannabis or cannabis products in a designated area on the licensed premises, upon approval of the board

- $5,000 application fee

Cannabis cultivation facility license:

- Allows for a licensee to sell cannabis to a licensed retail cannabis store, to a licensed cannabis product manufacturing facility or to another licensed cannabis cultivation facility

- May also apply for a cannabis product manufacturing facility license and retail cannabis store license.

- A cannabis cultivation facility that obtains additional cannabis establishment license(s) are allowed for a vertically integrated model

- $5,000 application fee

Cannabis product manufacturing facility license:

Two different types of licenses available.

Standard cannabis product manufacturing facility license

- Purchase cannabis from a licensed cannabis cultivation facility or from another licensed cannabis product manufacturing facility

- Manufacture, refine, process, cook cannabis products such as cannabis concentrate, edible products, ointments, tinctures and more

- Allows to sell cannabis extract and/or cannabis products to licensed retail cannabis stores or other licensed cannabis product manufacturing facilities

- $5,000 application fee

Cannabis concentrate manufacturing facility license

- Manufacture, refine, process and cook only cannabis concentrate

- Sell only cannabis concentrate to a licensed retail cannabis store or other licensed cannabis concentrate manufacturing facilities

- $1,000 application fee

Alaska Cannabis Market Stats and Projections

As of November 2023, the state had issued 694 recreational business licenses, and 464 of those companies were operational, according to the Alaska Alcohol and Marijuana Control Office (AMCO). Of the 464 operating businesses, there were 236 growers, 164 retail stores, 2 testing labs, 62 concentrates and product manufacturing producers.

Alcohol & Marijuana Control Office’s data shows that total retail sales in Alaska hit $245 million in 2020, up nearly 40% from 2019 ($180 million), rising to $261 million in 2021 and $277 million in 2022. Nine months of 2023 brought in about $200 million and total retail sales from program inception to 09/30/23 are estimated at about $1,350 million.

Alaska could become home to around 1,000 licensed cannabis businesses, according to regulator Cynthia Franklin, AMCO’s executive director.

Cannabis Taxes in Alaska

Effective Jan. 1, 2019, sales and transfers of cannabis are subject to the following tax rates:

- mature bud/flower are taxed at $50 per ounce;

- immature or abnormal bud is taxed at $25 per ounce;

- trim is taxed at $15 per ounce; and

- clones are taxed at a flat rate of $1 per clone.

Alaska Cannabis Market Infographics

Cannabis Cultivation Business Plan Sample, Alaska

'70% ready to go' business plan templates

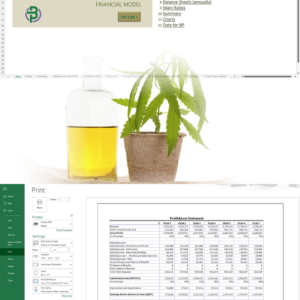

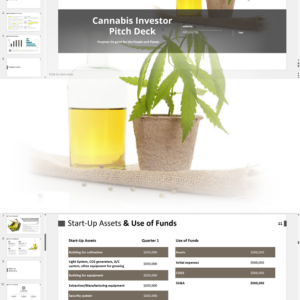

Our cannabis financial models and cannabis business plan templates will help you estimate how much it costs to start and operate your own cannabis business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Hemp CBD business plan templates are available at hempcbdbusinessplans.com.