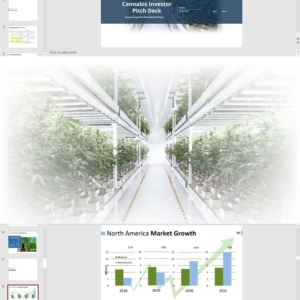

Cannabis Market in North America

The North America legal cannabis market amounted to about $33.5 billion in 2022 with the compound annual growth rate (CAGR) at 20%. The largest market was the United States, which totaled almost $30 billion, and it was followed by Canada with around $3.6 billion. The market is forecasted to grow to $46.5 billion five years later based on the Arcview Market Research report.

Canadian Cannabis Market Statistics

Canadian cannabis market has been steadily growing prior to the legalization of recreational cannabis. The country has seen an average of a 10 percent increase each month in the number of Canadian patients signed up to receive medical cannabis. The sale of dried cannabis has grown steadily at 6 percent a month, and the sale of cannabis oil has been growing by 16 percent a month.

Medical cannabis patients spent $224 million on cannabis in the second half of 2021, down from $294 million in the second half of 2020 and 23% lower than the record $316 million spent in the final six months of 2017, according to MJBizDaily. Canada’s medical cannabis market stayed flat through the first half of 2022 and totaled $213 million. The first half of 2023 brought in $248 million.

The federal government legalized recreational cannabis on October 17th, 2018 and sales at cannabis stores in the first three months after legalization totaled $151.5 million and reached $1,186 million in 2019, $2,625 million in 2020, $3,922 million in 2021 and $4,510 million in 2022, and in 2023, according to Statistics Canada, they exceeded $5 billion.

Canadian Cannabis Market Forecast

The total cannabis market in Canada is estimated to generate up to $7 billion in sales according to Deloitte’s forecast. The cannabis market is poised to have a major effect overall on Canada’s economy. One study from Deloitte Private pegged the potential economic impact of legalized recreational cannabis in Canada at more than $22 billion, including transportation, licensing fees and security.

BDS Analytics’ global legal cannabis forecast shows that the growth to be strong, with adult-use spending estimated to reach nearly $4 billion in 2021, driving a CAGR of 26% from 2019-2025 and grow to almost $6.5 billion by 2025.

Cannabis industry analysts predict that Canada’s cannabis industry ultimately would total between $4.9 and $8.7 billion. If the market meets prediction, Canada’s legal cannabis market would be comparable in size to its hard liquor or wine market.

Cannabis Fees and Taxes

Cost recovery for the regulation of cannabis includes four fees:

- Application screening fee: recovers the costs associated with screening new licence applications ($3,277 for standard licence applicants and $1,638 for micro and nursery licence applicants);

- Security clearance fee: recovers the costs associated with screening, processing, and issuing or refusing security clearances ($1,654);

- Import/export permit fee: recovers the costs associated with screening, processing, and issuing or refusing to issue an import or export permit for medical or scientific purposes ($610); and,

- Annual regulatory fee: recovers the aggregate costs of administering the cannabis regulatory program that are not covered under any of the other fees (2.3% of cannabis revenue for standard licence holders, or $23,000 if cannabis revenue is less than $1 million, and 1% on the first $1 million of cannabis revenue for micro and nursery licence holders or $2,500 in cases where cannabis revenue is less than $250,000).

- Licence holders who produce cannabis exclusively for medical purposes are exempt from the annual regulatory fee.

Taxes

The federal excise duty rate will be 25 cents per gram of cannabis, or 2.5 per cent of the producer’s sale price of that product. An additional rate will apply for an agreeing province or territory.

| Cannabis product | Flat‑rate cannabis duty | Ad valorem cannabis duty | Flat‑rate additional cannabis duty | Ad valorem additional cannabis duty |

|---|---|---|---|---|

| Flowering material included in the cannabis product or used in the production of the cannabis product | $0.25 per gram | 2.5% of the dutiable amount for the cannabis product | $0.75 per gram | 7.5% of the dutiable amount for the cannabis product |

| Non‑flowering material included in the cannabis product or used in the production of the cannabis product (this includes flowering material that is industrial hemp by‑product) | $0.075 per gram | 2.5% of the dutiable amount for the cannabis product | $0.225 per gram | 7.5% of the dutiable amount for the cannabis product |

The adjustment rates for the additional cannabis duty required when packaged and stamped cannabis products are delivered to a purchaser in a listed specified province are the following:

- Alberta, 16.8%;

- Nunavut, 19.3%;

- Ontario, 3.9%;

- Saskatchewan, 6.45%.

It is important to note that excise duties are not paid directly by consumers. Rather, they are paid by manufacturers.

Canadian Cannabis Market Infographics

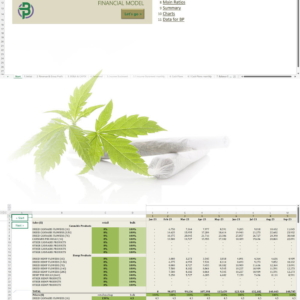

Cannabis Cultivation and Extraction Business Plan Sample, Canada

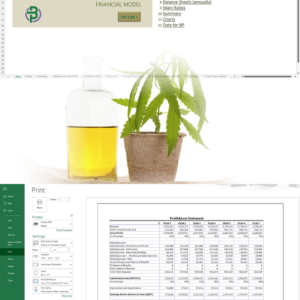

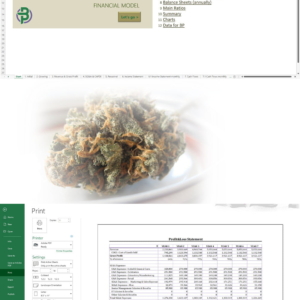

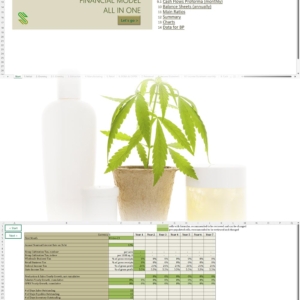

'70% ready to go' business plan templates

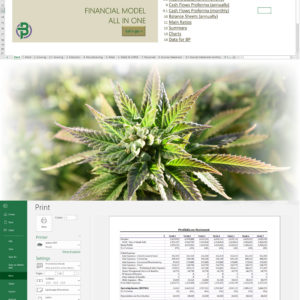

Our cannabis financial models and cannabis business plan templates will help you estimate how much it costs to start and operate your own cannabis business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Cannabis business plan templates for Canada can be found at cannabusinessplans.ca.