Oregon Cannabis Legalization

In 2015, Oregon Governor Kate Brown signed an emergency bill declaring cannabis sales legal to recreational users from dispensaries starting October 1, 2015, during an “early sales” period, through the end of 2016. Additional legislation signed into law by Governor Brown in March 2016 allowed the sale of medical and recreational cannabis from the same outlets. Effective January 1, 2017, cannabis can be sold for recreational use only by businesses that have obtained a “recreational license” from the OLCC, such businesses can also sell for medical use.

Oregon Cannabis Applications

Through December 2023, there were 3,082 submitted applications and 2,804 (2,862 in 2022) licensed recreational cannabis businesses in Oregon, including 1,389 (1,408) producers, 312 (331) processors, 269 (276) wholesalers, 818 (827) retailers, 15 (19) laboratories and 1 research facility.

Under the final version of HB 4016, applications for producer, processor, wholesaler and retailer licenses submitted after January 1, 2022 will not be approved. The licensing moratorium will last until March 31, 2024, at which time licensing will resume.

Oregon Cannabis Market: Stats and Projections

In Oregon where concentrates and edibles were only allowed for the first time in the adult-use channel in July 2016, the transformation in category happened almost overnight.

Oregon cannabis market had an established medical cannabis industry before the legalization of recreational cannabis, and early adult-use sales through existing dispensaries took place before the first rec-only retailers were licensed, which explains the relatively quick turnaround time.

Retail sales grew from $643 million in 2018 to about $795 million in 2019 and reached about $1.1 billion in 2020.

In January 2021, total sales reached $101 million, 45% higher than January of 2020. Then, in April, the state hit $110 million in total sales, breaking $100 million in adult-use sales in a single month for the first time since recreational cannabis sales began. In 2021 the combined sales reached the $1 billion mark in October and totaled $1,177 million in December. 2022 and 2023 brought in about $994.2 million and $955.4 million, respectively.

While flower sales remain dominant in Oregon, with flower (including pre-rolled forms) contributed about 54.5% (56% in 2022 and 60% in 2021) of sales year-to-date, as growth in other categories including concentrates, edibles and topicals all outpaced flower.

Cannabis Taxes in Oregon

The permanent, 17-percent tax on the sales price of all recreational cannabis products will take effect once a facility is licensed. Cities and counties can decide whether or not to adopt an additional local tax of up to 3 percent on retail sales.

Oregon Cannabis Market Infographics

Cannabis Cultivation and Extraction Business Plan Sample, Oregon

'70% ready to go' business plan templates

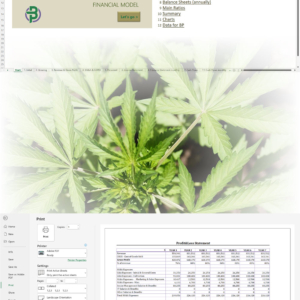

Our cannabis financial models and cannabis business plan templates will help you estimate how much it costs to start and operate your own cannabis business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

We also offer hemp CBD business plan templates at hempcbdbusinessplans.com.