Cannabis Legalization in Colorado

Colorado cannabis market has been legal for medical use since 2000 and for recreational use since late 2012. Colorado became the first state to approve 280E deductions in 2014, that allows cannabis companies to deduct business expenses from their state income taxes.

Two new bills, House Bill 1230 and House Bill 1234 created two new business licenses for cannabis tasting rooms and cannabis deliveries starting with medical products in 2020 and recreational to follow in 2021.

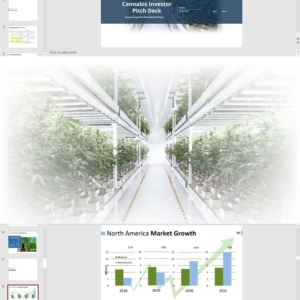

Colorado Cannabis Market: Stats and Projections

Colorado’s retail sales in adult-use and medical dispensaries combined grew from $675 million in 2014, to about $2.19 billion in 2020 and $2,229 million in 2021 before declining to $1,769 million in 2022, including $231 million medical and $1,538 million recreational cannabis sales.

Cannabis consumers spent $1,529 million in 2023, including $185 million medical and $1,344 million recreational cannabis sales, according to data from the Department of Revenue’s Marijuana Enforcement Division. Cannabis sales averaged $1.95 million ($2.30 million in 2022) per retail location in Colorado’s adult-use market and $0.53 million ($0.59 million in 2022) per location in the medical channel.

Medical:

- Dispensaries – 349 (390)

- Cultivators – 302 (397)

- Manufactures – 185 (209)

- Testing – 7 (10)

- Transporters – 9 (13)

- Delivery – 12 (16)

- Retail Stores – 689 (670)

- Cultivators – 607 (767)

- Manufactures – 262 (294)

- Testing – 7 (10)

- Transporters – 25 (36)

- Delivery – 35 (42)

- Hospitality – 12 (9)

Recreational: 550,000 – 650,000

Recreational: $1.344 billion (up from $1.538B in 2022)

Demand for Cannabis Concentrates in Colorado

In 2014 when adult-use just launched in Colorado, over 70% of sales came from dried flower; in 2016, that was down to 55%. In contrast, concentrate sales were $20 million in 2014, or 13% of sales. By the end of 2016 they had jumped to $85 million and 25% of sales. Edibles (including candy, beverages, tinctures, and all food) more than tripled during the same period, from $17 million to $53 million, moving from 11% to 14% of sales. Vape pens and vape products, candy, and other portable and convenient methods of consumption are especially popular with Colorado consumers.

The contribution of sales from flower dropped to less than 50% in 2017 and to 44% in 2019 and increased from concentrates to 28% and 31% correspondingly in Colorado’s cannabis industry.

Colorado Cannabis Market Infographics

Cannabis Transportation Business Plan Sample, Colorado

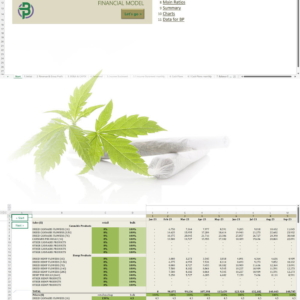

'70% ready to go' business plan templates

Our cannabis financial models and cannabis business plan templates will help you estimate how much it costs to start and operate your own cannabis business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Hemp/CBD business plan templates are available at hempcbdbusinessplans.com.