- Understand regulatory and legal requirements. Do market research.

Research the laws and regulations governing medical-use cannabis for more information about the regulatory requirements for licensure where you want to start your business.

Mississippi Cannabis Legalization

On November 3, 2020, voters approved Mississippi medical cannabis legalization through a ballot initiative in Mississippi. Legislation became law on February 2, 2022, when Governor Tate Reeves signed Senate Bill 2095, the Mississippi Medical Cannabis Act, that regulates the production and distribution of cannabis flowers and concentrates to qualified patients.

The Mississippi Department of Health (MDOH) is the primary agency that is over the medical cannabis program and handles the licensing, regulating and enforcement of laws relating to:

- Patient’s cards

- Medical Practitioners

- Cannabis Cultivation Facilities

- Cannabis Processing Facilities

- Cannabis Testing Facilities

- Cannabis Waste Disposal Entities

- Cannabis Transportation Entities

The Mississippi Department of Revenue (MDOR) is responsible for the licensing of medical cannabis dispensaries.

- Decide the type of cannabis business. Choose a location. Check local zoning regulations.

Cannabis Licenses Types Available in Mississippi

“A business entity licensed and registered by the MDOH that acquires, grows, cultivates, and harvests medical cannabis in an indoor, enclosed, locked, and secure area.”

- Application Fee: Micro-Cultivator: $1,500 (Tier 1, <= 1,000 sq. ft), $2,500 (Tier 2, < 2,000 sq. ft); Cultivator: $5,000 (Tier 1, < 5,000 sq. ft), $10,000 (Tier 2, < 15,000 sq. ft), $20,000 (Tier 3, < 30,000 sq. ft), $30,000 (Tier 4, < 60,000 sq. ft), $40,000 (Tier 5, < 100,000 sq. ft), $60,000 (Tier 6, >= 100,000 sq. ft)

- License Fee: Micro-Cultivator: $2,000 (Tier 1), $3,500 (Tier 2); Cultivator: $15,000 (Tier 1), $25,000 (Tier 2), $50,000 (Tier 3), $75,000 (Tier 4), $100,000 (Tier 5), $150,000 (Tier 6)

“A business entity that is licensed and registered by the MDOH that: acquires or intends to acquire cannabis from a cannabis cultivation entity or other cannabis processing entity; possesses cannabis with the intent to manufacture a cannabis product; manufactures or intends to manufacture a cannabis product from unprocessed cannabis or a cannabis extract; and sells or intends to sell a cannabis product to a medical cannabis dispensary licensed by MDOR or cannabis research entity licensed by the MDOH.”

How much does it costs to start a cannabis extraction business?

- Application Fee: Micro-Processor: $2,000 (Tier 1), $2,500 (Tier 2); Processor: $15,000

- License Fee: Micro-Processor: $3,500 (Tier 1), $5,000 (Tier 2); Processor: $20,000

“An independent entity licensed and registered by the MDOH that analyzes the safety and potency of cannabis.”

- Application Fee: $10,000

- License Fee: $15,000

“A business licensed and registered by the MDOH that is involved in the commercial disposal or destruction of medical cannabis.”

- Application Fee: $5,000

- License Fee: $7,500

“An entity licensed and registered with the MDOH that acquires, possesses, stores, transfers, and transports cannabis and/or cannabis products to other medical cannabis establishments licensed by the MDOH and/or MDOR.”

- Application Fee: $5,000

- License Fee: $7,500

“A research entity at any university or college in this state or an independent entity licensed and registered by the MDOH pursuant to this chapter that acquires cannabis from cannabis cultivation entities and cannabis processing entities in order to research cannabis, develop best practices for specific medical conditions, develop medicines and provide commercial access for medical use.”

- Application Fee: $10,000

- License Fee: $15,000

“An entity licensed and registered with the MDOR that acquires, possesses, stores, transfers, sells supplies, or dispenses medical cannabis, equipment used for medical cannabis, or related supplies and educational materials to cardholders. A dispensary can only be in an area zoned commercial or in an area that is not otherwise prohibited from having commercial businesses.”

- Application Fee: $15,000

- License Fee: $25,000

Cannabis Delivery in Mississippi

Under current regulations, a dispensary must not sell or distribute cannabis products using a delivery service. Qualified patients can visit medical marijuana dispensaries to buy up to 24 MMCEU’s within 30 days.

“MMCEU” means Mississippi Medical Cannabis Equivalency Unit. One unit of MMCEU shall be considered equal to:

1. Three and one-half (3.5) grams of medical cannabis flower;

2. One (1) gram of medical cannabis concentrate; or

3. One hundred (100) milligrams of THC in an infused product.

- Develop a solid cannabis business plan. Secure financing.

A typical cannabis business plan outline includes sections such as Executive Summary, Market Overview, Sales Strategy, Operating Plan, Organizational Structure (+ Diversity Plan) and Financial Plan.

'70% ready to go' business plan templates

We offer a wide range of '70% ready-to-go' cannabis business plan templates that will help you prepare a professional cannabis business plan document supported with expert financials and an investor pitch deck. All our templates are completely open and editable and you can use Word, Excel and PowerPoint to work with them.

- Prepare the required documents. Pay application fees. Submit applications.

An application must include the following:

- The names and other required information for all individuals and legal entities who are applicants.

- Any forms required by the Department and any information identified in the form that is required to be submitted.

- A map or sketch of the premises proposed for licensure, that must provide accurate measurements that allow the Department, at a minimum, to determine the precise main entrance location in reference to the rest of the premises. If the application is based on proposed construction not completed at the time of application, the applicant must submit construction plans. Proof that main entrance of proposed location is not within 1,000 feet of the property boundary line of any school, church, or childcare facility (Distance Waiver form required if within 1,000 feet). No medical cannabis dispensary may be located within a 1,500 feet radius from the main point of entry of the dispensary to the main point of entry of another medical cannabis dispensary.

- An operating plan and Standard Operating Procedures that demonstrate at a minimum how the applicant’s proposed premises and business will comply with applicable laws and rules regarding security; employee qualifications; record-keeping systems; hours of operation; types and quantities of cannabis products that will be produced at the facility; methods of cultivation or processing of cannabis and/or cannabis products, as applicable based on category of license applied for; labeling and packaging; transportation of cannabis and/or cannabis products, as applicable based on category of license applied for; waste disposal; recall of cannabis and/or cannabis products; preventing non-cardholders under the age of 21 from entering the licensed premises; and preventing non-cardholders from obtaining any items sold by the dispensary.

- If the municipality or county where the proposed cannabis facility will be located has enacted zoning restrictions, a sworn attestation by the applicant certifying that the proposed cannabis facility is in compliance with the restrictions.

- If the municipality or county where the proposed cannabis facility will be located requires a local registration, license, or permit, then the applicant must attach a copy of each obtained registration, license or permit issued to the applicant to the application.

- The names and other required information for all persons and/or entities who directly or indirectly own ten percent (10%) or more of the medical cannabis establishment applicant entity.

- Other information that may be required by the Department.

- Applicants shall provide proof of authorization to occupy the property for the proposed cannabis facility.

- Applicants must have a valid Sales Tax Permit for the proposed location.

- Applicants may not owe delinquent taxes.

Other facilities requirements:

- Facilities have to be indoors, enclosed, and secured against unauthorized entry.

- Licensees must have an operational alarm system with continuous 24/7 coverage.

- Licensees must have 24/7 video surveillance systems in place with on- and off-site monitoring capabilities.

- Licensees’ premises must be well-lit.

- Licensees must use commercial grade locks on outside doors and restrict access to the facilities to authorized personnel.

- Submit background check. Obtain the required licenses.

A background check is performed on each person who controls a financial or voting interest of 10% or more of, or an officer or board member of, a cannabis establishment.

Once your license is issued, you can download your license certificate from the licensing system. A physical copy of the license will be mailed to the address provided.

- Register your business as an employer and a tax payer.

- Keep track of your ongoing compliance requirements.

Physical security measures, good production practices, packaging, labelling, transport and reporting requirements, taxes and more.

Regular licenses issued by the Department require annual renewal. At the time of renewal, the licensee shall ensure that all material changes to the required plans and/or standard operating procedures have been communicated in writing to the Department.

Mississippi Cannabis Taxes

There are two taxes associated with the sale of medical cannabis. Applicants will be required to obtain applicable tax permits as part of the application process.

- Medical cannabis cultivators are subject to a 5% excise tax on the first sale/transfer of medical cannabis.

- Excise tax is due if the cultivator sells to a processing facility.

- Excise tax is due on the transfer of cannabis between related entities.

- Medical cannabis dispensaries will charge the standard 7% sales tax to cardholders at the point of sale.

Fair Market Values for Cannabis Excise Tax – https://www.dor.ms.gov/cannabis_taxes

Main steps in short

- Understand regulatory and legal requirements. Do market research.

- Decide the type of cannabis business. Choose a location. Check local zoning regulations.

- Develop a solid business plan. Secure financing.

- Prepare the required documents. Pay application fees. Submit applications.

- Submit background check. Obtain the required licenses.

- Register your business as an employer and a tax payer.

- Keep track of your ongoing compliance requirements.

Cannabis Cultivation, Extraction and Manufacturing Business Plan Sample, Mississippi

'70% ready to go' business plan templates

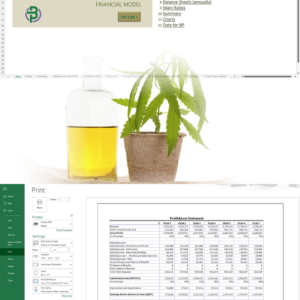

Our cannabis financial models and cannabis business plan templates will help you estimate how much it costs to start and operate your own cannabis business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Hemp/CBD business plan templates are available at hempcbdbusinessplans.com.