Cannabis Legalization in Massachusetts

In 2008 Massachusetts voters decriminalized the possession of small amounts of cannabis and in 2012 Massachusetts became the 18th state to open Massachusetts cannabis market to medical users through a ballot.

In November 2016, Massachusetts voters approved Question 4, the initiative to legalize the recreational use of cannabis for adults 21 years of age and older. In December 2016, the Massachusetts state legislature voted to delay sales of recreational cannabis for six months. Originally, licensing for cannabis shops was set to begin in January 2018, but the delay moved the date and first retail cannabis business opened in Massachusetts in November 2018.

Under the law, recreational cannabis is taxed 17 to 20%. The baseline tax is 17%, which is determined from a combination of a 6.25% sales tax and a 10.75% special excise tax on adult use. Cities and towns can choose to add a 3% tax on top of the 17%, tallying up to a 20% tax on retail cannabis.

In September 2019, the Cannabis Control Commission approved new regulations for Massachusetts cannabis market, adult and medical use of cannabis programs that introduce new license types – cannabis cafes and home delivery. There are 11 types of licenses for which an entity can apply.

In 2022, Massachusetts passed legislation that exempt businesses from Section 280E of the federal tax code that allows cannabis companies to deduct business expenses from their state income taxes.

Massachusetts Cannabis Market Stats

As of January 2024, 1,529 (1,154 in 2022) licenses have been awarded, including 511 retailer, 377 cultivator, 304 manufacturer, 35 microbusiness, 134 delivery, 122 courier, 15 transporter, 20 testing, 5 microbusiness delivery, 4 for cooperative and 2 for research facility licenses according to the official data. The review process includes a background check and a 60-day window during which the municipality in which the business hopes to locate must certify that the applicant has met all local requirements.

Cannabis stores sold about $1.93 million worth of cannabis products during the first month and in December 2019 total legal cannabis sales exceeded $246 million, according to figures released by the Cannabis Control Commission. In 2020, Adult-Use Marijuana Establishments generated about $700 million in gross sales despite two months of closures. In 2021 and 2022, retail sales reached $1.33 billion and $1.47 billion, respectively, while 2023 brought in nearly 1.57 billion in sales.

Since November 2018, total program revenue to date is about $5.52 billion.

In 2022, medical sales amounted to $268 million, while 2023 brought in $225 million. Medical cannabis patients were served by 93 dispensaries. Since March 2019 (medical sales data became available through METRC tracking system), total program revenue to date is about $1.22 billion.

Research from multiple cannabis data and investment firms predict Massachusetts can become such a travel destination.

Massachusetts Cannabis Market Infographics

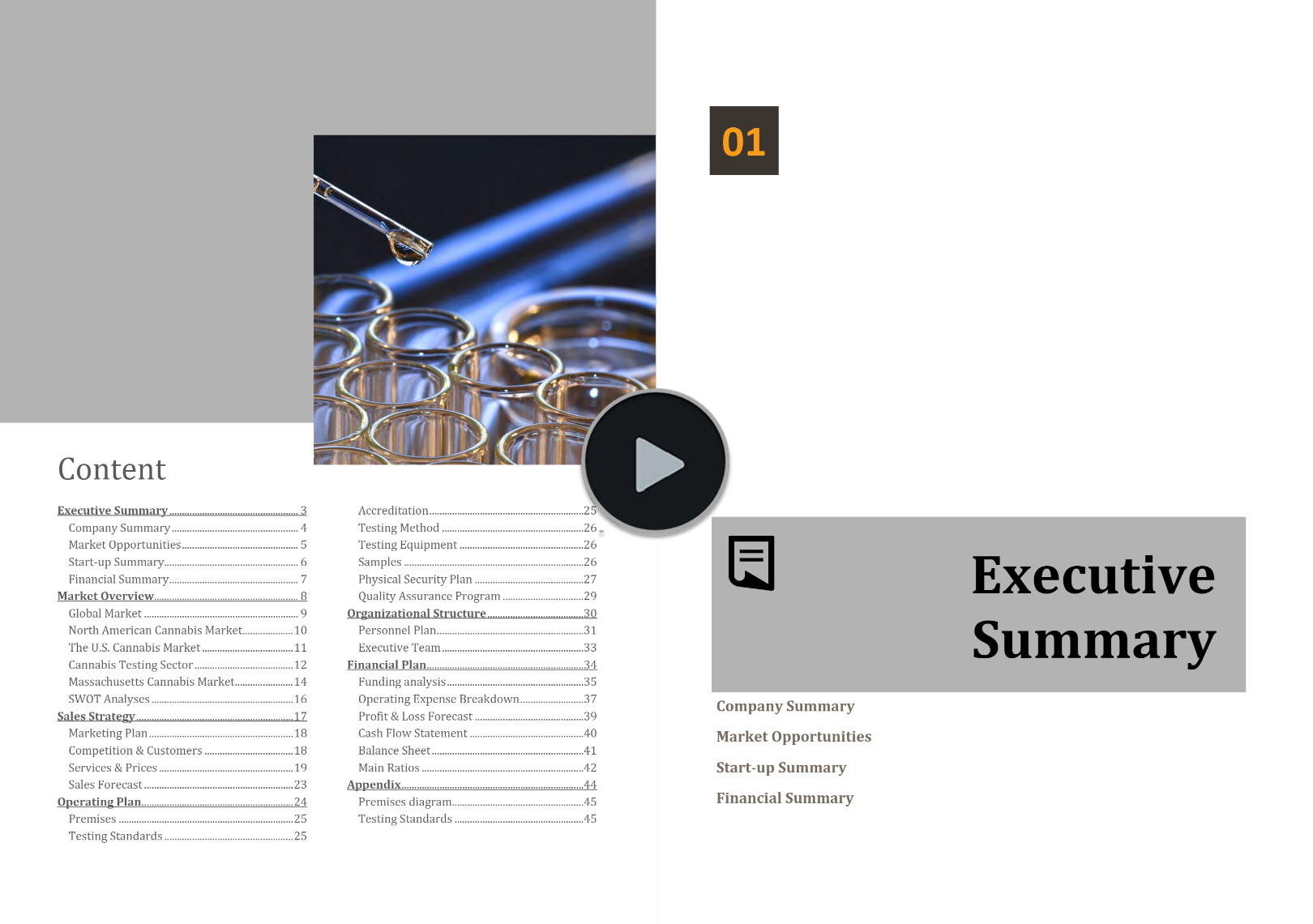

Cannabis Testing Business Plan Sample, Massachusetts

'70% ready to go' business plan templates

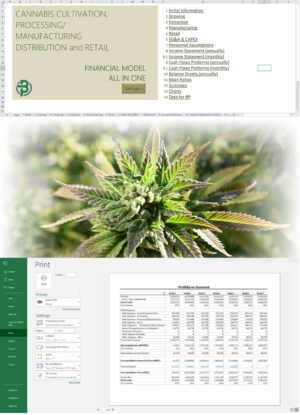

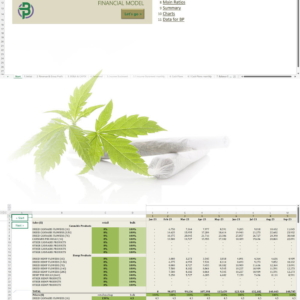

Our cannabis financial models and cannabis business plan templates will help you estimate how much it costs to start and operate your own cannabis business, to build all revenue and cost line-items monthly over a flexible seven year period, and then summarize the monthly results into quarters and years for an easy view into the various time periods. We also offer investor pitch deck templates.

Best Selling Templates

Hemp CBD business plan templates are available at hempcbdbusinessplans.com.